The Aviation Industry ‘Resembles a Hopeless Drunk, Lurching Towards the Next Crisis’

- Commercial Aviation News

- Apr 15, 2021

- 3 min read

The outlook for the aviation industry is turbulent at best, warned the Centre for Aviation (CAPA) founder and chairman emeritus, Peter Harbison, in his regular monthly contribution to the CAPA Live summit.

”How can we expect a sustainable industry built on junk bonds?,” he questioned in his presentation in the Apr-2021 edition of the virtual event.

The global aviation industry, savaged by the effects of COVID-19, today resembles a hopeless drunk, lurching towards the next crisis was the raw assessment of the present reality, according to the respected aviation commentator.

“Even the US airline majors – who operate inside a protected domestic market that has delivered higher profits than the rest of the world combined in recent years up to 2019 – have been bailed out three times and most have gone through Chapter 11 reincarnation since 2000,” explained Mr Harbison.

“This is clearly not a financially viable industry, yet with government support airlines are about to re-embark into an environment that is much more hostile than the ones which preceded COVID-19. Things need to change, even just to remain the same”, he added.

The April 2021 edition of CAPA Live – a monthly virtual summit, offering insights, information, data and live interviews with airline CEOs and industry executives across a next-gen virtual event platform – carried the theme ‘Airlines in Transition’ and examined the evolution of airline business models and the factors, including technology, that are driving change.

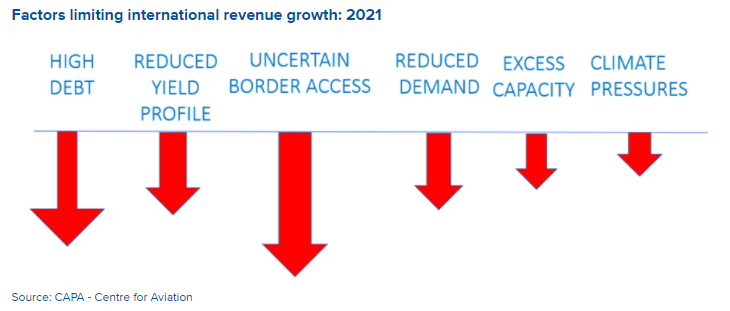

In his presentation Mr Harbison highlighted the five main ingredients in the future outlook for international aviation through 2021 – all are headwinds. These comprise the debt mountain, the yield valley, the COVID closed doors, the demand drought and the heavy weather.

Here’s some insights from his presentation on each of these ingredients in what could be a very bitter cake for the world’s airlines.

The debt mountain – “airlines have taken on vast amounts of new debt, fuelling massive repayment costs. Profitability will be highly elusive near-term, making further cash-raising more difficult. According to the A4A, US airlines have coped with the Covid crisis “in part by taking on billions in debt”. The airline body says net interest expense doubled from 2019 to 2020 and estimates it will exceed USD16 billion in 2021-2023.”

The yield valley – “leisure traffic and VFR – low yielding segments for airlines – will dominate travel profiles for the remainder of 2021 and beyond. Fewer business travellers – the key to long haul full-service operations – will take to the skies, as businesses reassess plans and look to shave costs. So average yields are likely to crash by 30% or more this year. And even if yields do eventually climb, can airlines survive another year at these levels? In this environment, low costs (ie LCCs) are king.”

The COVID closed doors – “reopening national barriers will be tortuous and uncertain. Very few countries will be vaccinated to the extent to provide herd immunity, and therefore reluctant to expose residents to fresh waves of infection. Similarly travellers will be wary of countries with high infection rates, even if they are permitted to enter. Vaccine passports may help, but standardisation and mutual recognition are enormously important. But multilateral consensus on access principles is a long way off, so most reopening will be achieved bilaterally – and slowly.”

The Demand drought – “while ‘pent-up demand’ will provide an initial surge in (mainly leisure/VFR) demand, average booking levels will remain well below 2019 levels throughout 2021. This implies a combination of lower fares to stimulate traffic and excess capacity in the market, meaning airlines with high costs will struggle to compete in a sustainable way.”

The heavy weather – “add to this, the ‘heavy weather’ of climate change reform pressures, which will suppress demand and constrain expansion. Expect ‘flight shaming’ to make a return as demands intensify from governments and consumers for aviation to reduce emissions. The Triple Bottom Line – ‘profit, people, and the planet”’ – will constrain business travel, just as corporations have adapted well to the ‘post-travel economy’ dominated by effective virtual meetings.”

According to Mr Harbison, the outlook is “more red ink and an industry weakened and vulnerable”. For almost all airlines, 2021 will continue to be marked by cash burn and losses, he projects. Recovery will not begin seriously before 2H2021, firstly in domestic markets and aided there by vaccinations. This will mean “a much smaller market pie and much smaller full-service airline industry, perhaps up to 50% smaller, will be the outcome,” says Mr Harbison.

Via CTC

Books From KJM Today:

Coming Soon:

The Web's Premier Resource for Airport History: